For those of you who are unfamiliar, the Tax Cuts and Jobs Act is a new law that was passed on December 15th, 2017. This new act impacts Tax years 2018 and years to come. It reforms the individual income tax code by lowering tax rates on wages, investment, and business income broadening the tax base and simplifying the tax code. This plan would lower the corporate income tax rate to around 21%.

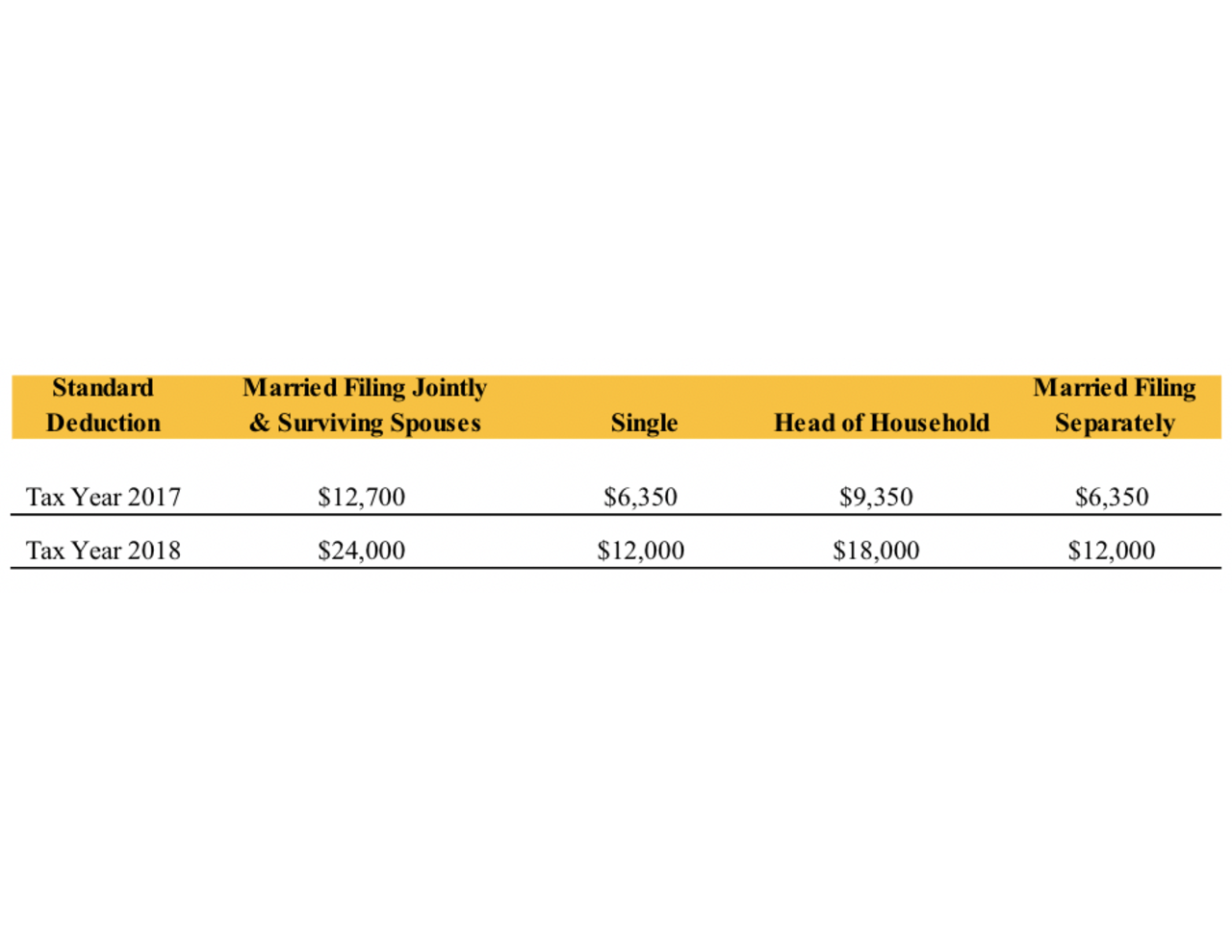

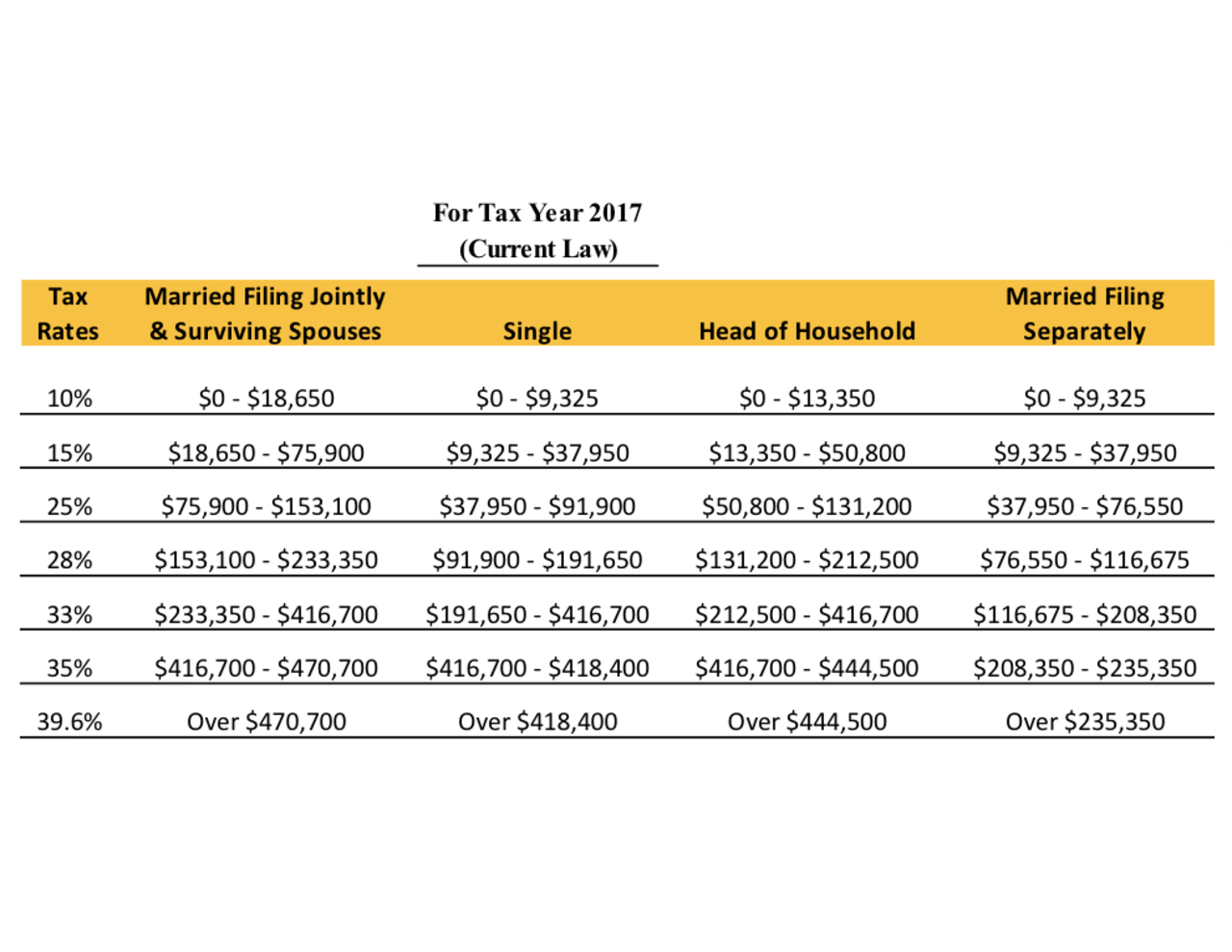

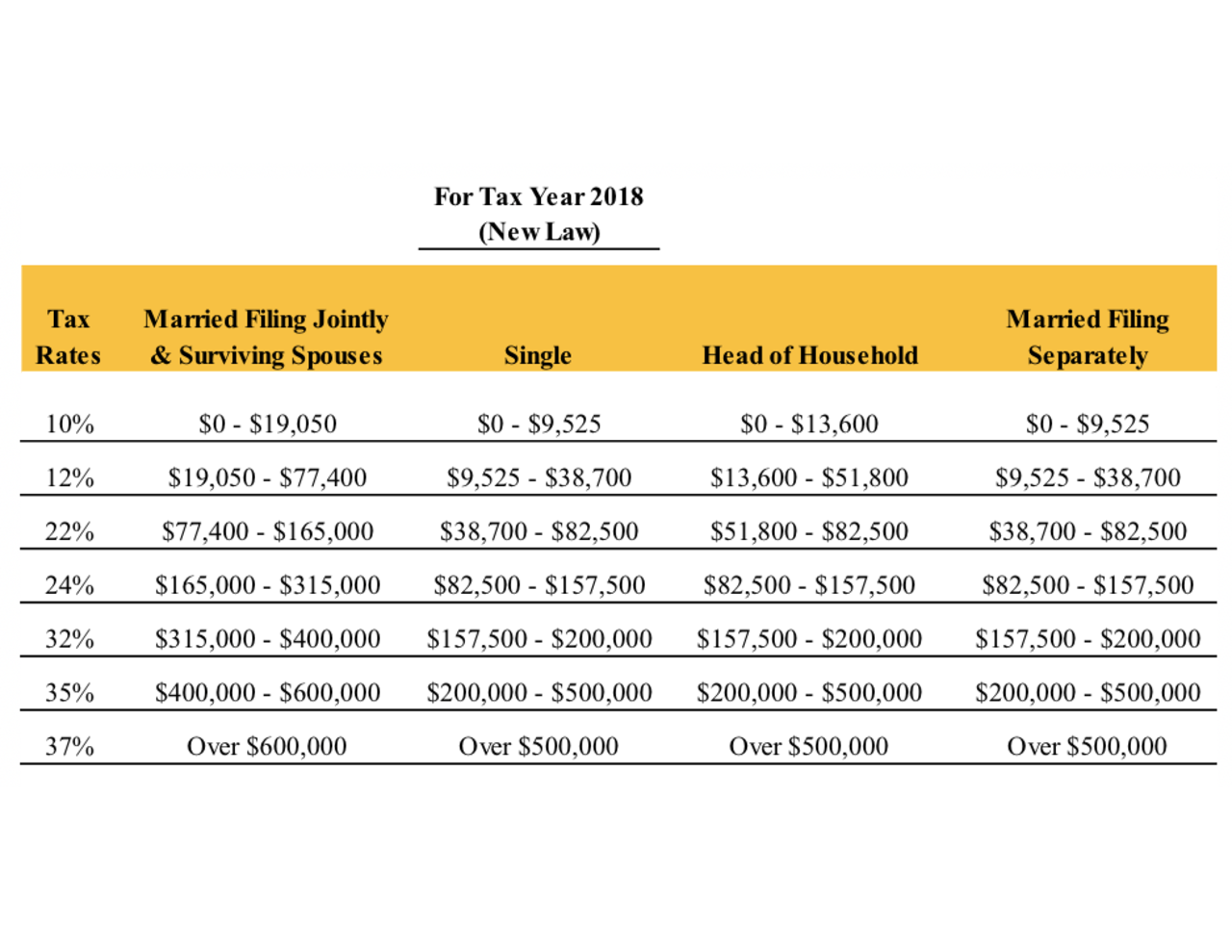

The following tables give the breakdown to the new changes compared to the former brackets:

For Tax Year 2017 (Current Law)

For Tax Year 2018 (New Law)

This table includes standard deduction changes which eliminates personal exemptions as well as eliminates the individual mandate penalty effect January 1st, 2019.

(Note: You will face a penalty if not covered in the tax year of 2018.)